Dear Valued Clients,

In these volatile markets we want you to know your ACT Advisors team is on top of what is happening with daily research calls and up to the minute technical data. We are actively looking for opportunities to advance and protect your portfolio and making plans for action.

We thought it might be helpful for you to understand the economic impact we are expecting and how similar events have played out in the past.

How Might Coronavirus Impact the United States Economy?

At this point, our base case is that any economic disruption in the United States may be modest and short-lived, as we expect domestic efforts at containment to be more successful and have less economic disruption than in China. The outbreak may trim 0.25–0.5% from U.S. GDP over the next couple of months due to global supply chain disruption, falling export demand, and decreased tourism. If evidence emerges over the next month or so that the virus is being contained successfully, as we expect, the economic impact would likely be at the better end of that range (0.25%). In that scenario, damage to business and consumer confidence would be limited, setting the stage for a potential second-quarter rebound. We believe our 1.75% U.S. GDP growth forecast may still be achievable.

How Does Coronavirus Compare to Prior Outbreaks?

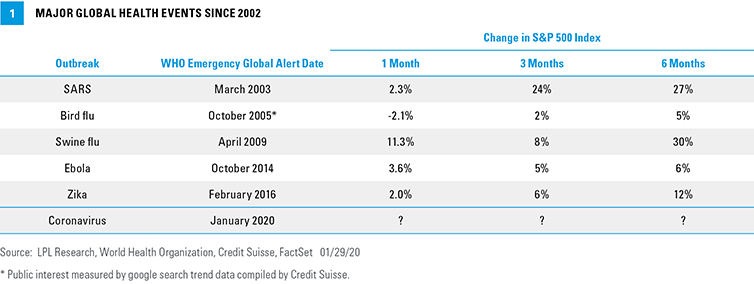

History shows us the market impact from similar events has tended to be modest and short-lived. We looked at prior outbreaks, including SARS, bird flu in 2005-06, and swine flue in 2009, for comparisons [FIGURE 1].

We also included Ebola and Zika, but the regional concentration of Ebola in West Africa and the minimal loss of life from Zika made those cases less comparable (although we do not minimize the loss of a single life). The Middle East respiratory syndrome (MERS) was excluded as well because there were only two cases in the United States and no deaths. The U.S. stock market shrugged off all of these health scares and took cues from U.S. economic trends, which continued uninterrupted:

SARS. After the SARS outbreak in late 2002 and early 2003, which we consider the most comparable to the current coronavirus outbreak, the 2003–07 bull market began. The market reflected recovery from the 2001 recession and 2002 accounting scandals and the start of the Iraq War. The S&P 500 surged 24% in the three months after the World Health Organization (WHO) issued a global emergency alert. During that period, the Hang Seng Index in Hong Kong suffered a peak-to-trough decline of 14.8%, while the S&P 500 fell about 2% at its lowest point.

The temporary and modest loss of Chinese output during the second quarter of 2003 was quickly recovered in the third quarter of 2003, helped by Chinese government stimulus targeted toward the most-impacted travel-related businesses. There were no SARS-related deaths in the United States, and the U.S. economy was largely unaffected.

Bird flu. Stock market gains were more modest following the bird flu outbreak in 2005. Still, the S&P 500 managed gains of 2% and 5% over the subsequent three and six months after public interest in the disease peaked, based on Google search trends (source: Credit Suisse).

Economic impacts were quite limited even in affected Southeast Asia countries. Growth of Indonesian economic output slowed in 2005 but returned to trend in 2006, while growth in the Vietnamese economy continued uninterrupted.

Swine flu. Swine flu was the most deadly global health event in recent decades, with an estimated 200,000 deaths. That’s a big and scary number. For perspective, however, WHO estimates that as many as 650,000 people die from the seasonal flu each year. As with the traditional flu, a tiny fraction of swine flu cases ended in death—just 1 per 5,000 cases.

During the three and six months following WHO’s global emergency alert, the S&P 500 rallied 8% and 30%. This period coincided with the start of the current bull market as investors anticipated the end of the 2007–09 Great Recession and Global Financial Crisis. This outbreak had no noticeable impact on U.S. or global output.

Focus on Fundamentals

As always, we continue to focus on the fundamentals of the economy, interest rates, and corporate profits. The generally favorable economic backdrop is the reason we were not sellers of stocks into weakness related to the U.S.-Iran conflict, nor are we sellers on the coronavirus outbreak. That doesn’t mean we expect a smooth ride for markets. We recognize that strong gains late last year may limit potential advances this year.

As always if you want to discuss any of this further contact us at (828) 398-2802. Thank you for your business and your trust and confidence during volatile markets.

The ACT Advisors Team

[hr width=”1px” color=”#D3D3D3″ style=”dashed”][/hr]

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.