WHEN YOU ACT, YOU GET MORE

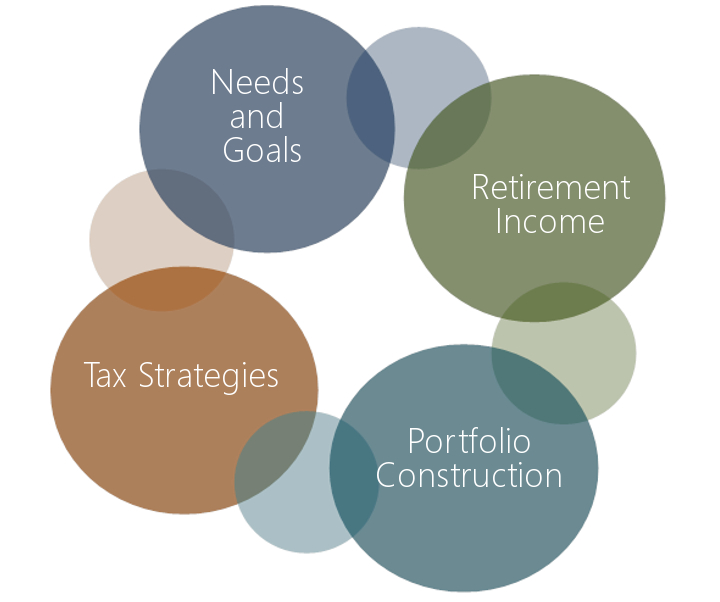

ACT Advisors® provides independent and on-going professional advice to investors. Using our 5 Step Process, our team of financial advisors develops a custom low total cost investment portfolio designed to help reach your unique financial goals. As your financial professionals, we do everything in our power to keep you focused on where you want to go, advise you on how to get there, and help you maintain a disciplined approach to pursuing your dreams.

In our introductory fact-finding meeting, we’ll evaluate your current investment strategy. You will find out if your current portfolio is positioned to help manage your assets and if your investments are on track to help you meet your financial goals. You will gain valuable insight into the risks of your portfolio—are you taking more risk than necessary?

We will determine your risk tolerance, taking into consideration your current financial situation, income needs, timeline, and the level of risk you’re comfortable with. From there, we’ll help you define short- and long-term objectives that tie in with your financial goals.

We develop a plan that targets your short and long-term objectives so we can help you reach your goals at every stage of your life.

We identify the right asset classes and investment vehicles for you based on your risk profile, objectives and timeline. We match your goals with the most appropriate mix of investments and financial planning strategies. Working closely together, we’ll have access to the information, products and services that will help you make educated financial decisions to pursue your goals in the best possible manner.

We build a low total cost investment portfolio to facilitate your investment plan. Learn more about our fee-only asset management.

We monitor and rebalance your portfolio to help keep it true to your needs and objectives. Once your plan has been implemented, we will closely monitor your investment options as well as events in the world’s financial markets, making adjustments as needed when your objectives or the economic climate changes. We personally manage your portfolio, rebalancing or reallocating as required, pursuing only those courses of action that are well-suited to your objectives.

During our initial fact finder meeting, we’ll evaluate your current investment strategy. Then each year we will provide you with an in-depth portfolio review to ensure your accounts are being managed in light of your current objectives and goals.

ACT Advisors® are independent. We have no proprietary products, or any other conflicts that can get in the way, so our recommendations are objective. Our team of advisors will develop an investment strategy to help you reach your financial goals.

Individualized service and support are of paramount importance to us. In periodic account reviews, our advisors will discuss your changing needs and, if necessary, realign your objectives. Then, we’ll review your goals and the progress we’ve made towards reaching them.