[page_container]

[/page_container]

[/page_container]

[page_container]

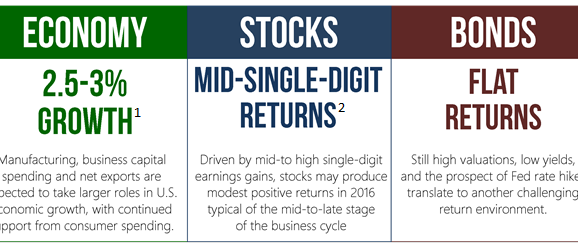

A key to success, in life and investing, is juggling the familiarity and wisdom of old routines with the adjustments demanded by an ever-evolving world. As we look forward to 2016, we expect a return to routine for some key areas of the economy and market, but by a path that may catch some investors unprepared. Investors will need a solid plan to navigate the changing landscape as they adjust to changes like the start of Federal Reserve (Fed) rate hikes, a maturing economic cycle, and the 2016 elections. Some of LPL Research’s expectations for 2016 include:

U.S. economic growth of 2.5–3%.

The mix of that growth may look different than in 2015, with manufacturing, business capital spending, and net exports taking larger roles. Labor markets are almost back to long-term expectations, and inflation may be poised to accelerate. An extraordinary extended period of loose monetary policy in the United States should start to normalize.

Mid-single-digit returns for the S&P 500.

Stocks, we believe, will not collapse, as many think, or soar, as many hope, but may offer near historical routine returns. Earnings may start to normalize, and oil markets should find their equilibrium. International markets may re-emerge as a more viable investing opportunity. But we are still in the second half of the economic cycle, and investors need to be vigilant about monitoring pockets of volatility and potential signs of an economic downturn.

Limited returns for bonds.

The year as a whole may look similar to 2015, with bond prices facing the challenges of high valuations, steady economic growth, and the prospect of interest rate hikes. Still, bonds play a vital role in investors’ portfolios to help with risk mitigation and diversification.

By embracing new routines, investors will be able to focus on what matters most to markets, block out short-term distractions that will quickly fade, and seek to make progress toward long-term financial goals.

[hr width=”1px” color=”#9b59b6″ style=”dotted”][/hr]

1 Our forecast for GDP growth of between 2.5–3% is based on the historical mid-cycle growth rate of the last 50 years. Economic growth is affected by changes to inputs such as: business and consumer spending, housing, net exports, capital investments, and government spending.

2 Historically since WWII, the average annual gain on stocks has been 7–9%. Thus, our forecast is in-line with average stock market growth. We forecast a mid-single-digit gain, including dividends, for U.S. stocks in 2016 as measured by the S&P 500. This gain is derived from earnings per share (EPS) for S&P 500 companies assuming mid- to high-single-digit earnings gains, and a largely stable price-to-earnings ratio (PE). Earnings gains are supported by our expectation of improved global economic growth and stable profit margins in 2016.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. Indexes are unmanaged and cannot be invested into directly.

Economic forecasts set forth may not develop as predicted.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not ensure against market risk.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise and bonds are subject to availability and change in price.

This research material has been prepared by LPL Financial LLC.

[/page_container]